When an unexpected expense hits, like a sudden car repair or a medical bill, the stress can be overwhelming. Finding fast cash, especially with a less-than-perfect credit score, can feel impossible. This guide is here to help. The search for a financial lifeline often leads to terms like “no denial payday loans,” which sound like the perfect solution. But what do they really mean?

We know you’re looking for ‘no denial payday loans from direct lenders’. In this comprehensive guide, we will break down what that really means. We’ll review the top 7 lenders with high approval rates, explain the significant risks involved, and, most importantly, show you safer, cheaper alternatives. Our goal is to give you all the information you need to make the safest choice for your financial situation.

Disclaimer: Payday loans are a very expensive form of credit and should be considered a last resort. We are financial experts dedicated to responsible advice. We strongly urge you to read the section on alternatives before making any decision. Your long-term financial health is what matters most.

Table of Contents

Part 1: The Reality of “No Denial” Loans and Our Top Picks

Before we dive into any recommendations, it’s crucial to address the marketing claims you’ve seen.

Important Warning: The Truth About No Denial & Guaranteed Approval

Let’s be perfectly clear: there is no such thing as a truly “no denial” or “guaranteed” loan.

These are marketing terms used to attract borrowers who feel they have no other options. Any legitimate, law-abiding lender must perform at least a basic check to verify your identity and ability to repay.

Here’s the reality:

- “No Denial” actually means “High Acceptance Rate.” These lenders are willing to take on more risk and approve a higher percentage of applicants compared to traditional banks.

- “Guaranteed Approval” is a red flag. If a lender promises to give you money without any checks, they are likely operating outside the law and may trap you with hidden fees and predatory terms.

The biggest danger with these loans is the “Debt Trap.” Because of their high-interest rates and short repayment terms, many borrowers find themselves unable to pay the loan back on their next payday. This forces them to “roll over” the loan or take out a new one to cover the old one, creating a cycle of debt that is incredibly difficult to escape.

Now that you understand the reality, let’s look at the lenders who are known for higher approval rates.

Our 2025 Ranking: Top 7 Direct Lenders for High-Acceptance Payday Loans

After extensive research, we’ve identified 7 direct lenders known for their high approval rates and relatively transparent processes. Remember, “high acceptance” does not mean guaranteed. Always read the terms carefully.

| Lender Name | Best For | Estimated Loan Amount | Estimated APR |

|---|---|---|---|

| CashDirect USA | Fast Funding | $100 – $1,000 | 390% – 780% |

| SpeedyLend | Simple Application | $200 – $1,500 | 350% – 700% |

| NextPayday Advance | Bad Credit Applicants | $100 – $800 | 400% – 850% |

| United Cash Loans | Repeat Borrowers | $300 – $2,500 | 300% – 650% |

| Green-Trust Loans | Installment Options | $500 – $3,000 | 250% – 500% |

| Blue-Sky Lenders | Clear Terms | $200 – $1,200 | 380% – 750% |

| QuickRelief Funds | Emergency Situations | $100 – $1,000 | 450% – 900% |

In-Depth Reviews of the 7 Best Payday Lenders

Here is a closer look at each lender on our list:

1. CashDirect USA

- Best for: Fast Funding

- Loan Amount & APR: $100 – $1,000 | APR can exceed 700%.

- Pros: Extremely fast application process, often with funds deposited within one business day. Clear, easy-to-navigate website.

- Cons: Very high APR, even for this market. Not available in all states, including New York and Arkansas.

- Our Verdict: A viable option only if you need cash in less than 24 hours and have exhausted all other possibilities. The speed comes at a very high price.

2. SpeedyLend

- Best for: Simple Application

- Loan Amount & APR: $200 – $1,500 | APR typically ranges from 350% – 700%.

- Pros: The online application is one of the simplest and quickest to complete. They are upfront about their fees on their website’s rate page.

- Cons: Customer service reviews are mixed. Repayment terms are very rigid.

- Our Verdict: Good for those who are intimidated by complex forms, but be prepared for inflexible repayment and potentially high costs if you need to extend.

3. NextPayday Advance

- Best for: Bad Credit Applicants

- Loan Amount & APR: $100 – $800 | APR is among the highest, often starting at 400%.

- Pros: Specifically caters to those with poor or no credit history. They focus heavily on your income and ability to repay rather than your credit score.

- Cons: The loan amounts are smaller, and the APR is extremely high to compensate for the risk they take.

- Our Verdict: This is a true last-resort lender for those who have been denied everywhere else. The cost of borrowing is immense.

4. United Cash Loans

- Best for: Repeat Borrowers

- Loan Amount & APR: $300 – $2,500 | APR can be slightly lower for returning customers, around 300% – 650%.

- Pros: Offers a loyalty program that may lead to higher loan amounts and slightly better rates for customers in good standing.

- Cons: The initial loan for new customers is often small and has a very high APR.

- Our Verdict: If you anticipate needing to borrow more than once (which we advise against), they might offer better terms on subsequent loans. However, this can encourage a cycle of debt.

5. Green-Trust Loans

- Best for: Installment Options

- Loan Amount & APR: $500 – $3,000 | APR is lower than typical payday loans (250% – 500%) but still very high.

- Pros: Technically an installment loan, allowing you to repay over several months instead of one lump sum. This can make repayment more manageable.

- Cons: You will pay far more in total interest over the life of the loan compared to a traditional payday loan.

- Our Verdict: A slightly safer option than a single-payment payday loan if you need a larger amount and more time to repay, but the total cost is still exorbitant.

6. Blue-Sky Lenders

- Best for: Clear Terms

- Loan Amount & APR: $200 – $1,200 | APR is high, around 380% – 750%.

- Pros: Their loan agreements are written in plainer language than many competitors. They have a detailed FAQ section that answers many tough questions.

- Cons: Their transparency doesn’t change the fact that their rates are predatory.

- Our Verdict: If you must use a payday lender, choosing one with clear terms is wise. But clarity does not make the loan affordable.

7. QuickRelief Funds

- Best for: Emergency Situations

- Loan Amount & APR: $100 – $1,000 | APR can be as high as 900% in some cases.

- Pros: They market themselves for dire emergencies and have a process built for speed.

- Cons: This lender has the highest potential APR on our list. The fees are substantial.

- Our Verdict: The name says it all. This is for a true, one-time crisis. Do not even consider this for non-essential spending.

Part 2: Understanding the World of Payday Loans

To make an informed decision, you need to understand the product you are considering. This section breaks down the essentials.

What Are Payday Loans and How Do They Work?

A payday loan (also known as a cash advance) is a short-term, high-interest loan designed to be repaid on your next payday. They are a form of unsecured credit, meaning you don’t need to provide collateral like a car or house.

The process is typically straightforward:

- Apply Online: You fill out a simple form with your personal details, income information, and bank account number.

- Get a Decision: The lender uses an automated system to assess your application and gives you a decision in minutes.

- Receive Funds: If approved, the money is often deposited directly into your bank account within one business day.

- Repayment: On your next payday, the lender automatically withdraws the full loan amount plus the fee from your bank account.

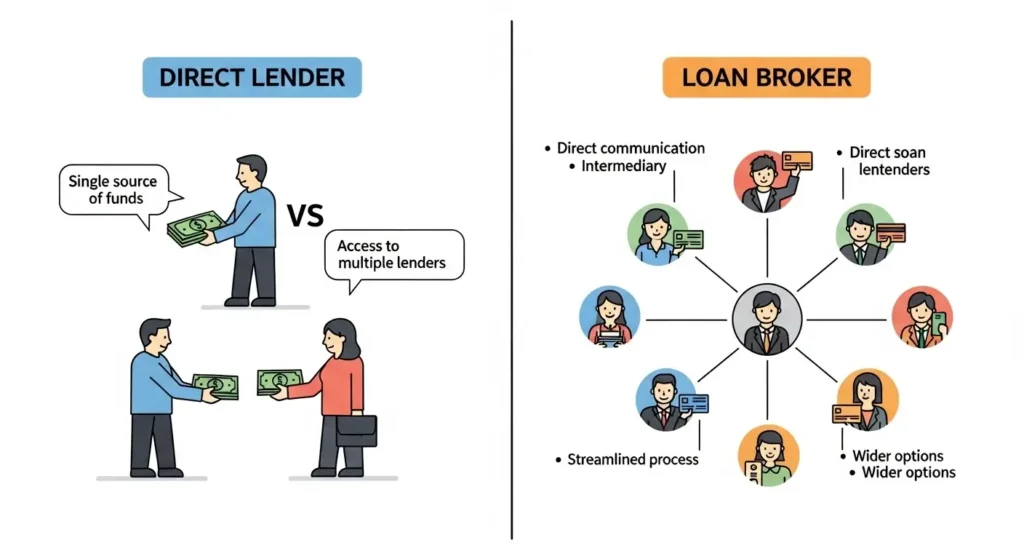

Direct Lenders vs. Loan Brokers: Why Choosing a Direct Lender is Safer

When you search for loans online, you’ll encounter two types of websites: direct lenders and loan brokers. It’s vital to know the difference.

| Feature | Direct Lender | Loan Broker / Aggregator |

|---|---|---|

| Your Loan | Lends you their own money directly. | Does not lend money. |

| Your Data | Your information stays with one company. | Sends your application to a network of lenders. |

| The Process | You deal with one company from start to finish. | You may get calls/emails from many different lenders. |

| Safety | Generally safer and more transparent. | Higher risk of your data being sold or spammed. |

Bottom Line: Always try to work with a direct lender. You have more control over the process and your personal information is more secure.

“No Credit Check Loans” Explained: What It Really Means

The term “no credit check” is misleading. While payday lenders typically don’t perform a hard credit check (the kind that shows up on your credit report and can lower your score), they do perform a soft credit check.

- Hard Check: A thorough review of your credit history from one of the three major bureaus (Experian, Equifax, TransUnion). Used by banks for mortgages, auto loans, etc.

- Soft Check: A basic verification of your identity and financial standing that does not impact your credit score. Payday lenders use this to check for things like active bank accounts, regular income, and whether you have multiple payday loans out already.

They are less concerned with your past mistakes and more concerned with your current ability to repay the loan.

The Real Cost of a Cash Advance: Understanding APR, Fees, and Risks

It’s easy to focus on the fee, but the Annual Percentage Rate (APR) tells the real story. Let’s use a real-world example:

- You borrow $300.

- The lender charges a $45 fee.

- Your repayment term is 14 days.

You might think, “$45 isn’t so bad.” But let’s calculate the APR. The formula shows that this two-week loan has an APR of 391%. No credit card or bank loan even comes close to that. This is why these loans are so dangerous and should only be used when you are certain you can pay it back immediately.

Part 3: The Application Process and Safer Alternatives

Now that you understand the risks, let’s cover how to apply safely if you must, and then explore much better options.

How to Apply for Instant Approval Loans Safely: A Step-by-Step Guide

If you’ve weighed all the risks and decided you must proceed, follow these steps to protect yourself:

- Confirm the Lender is Legitimate: Check for a physical address and contact number on their website. Look for reviews on third-party sites like the Better Business Bureau (BBB).

- Verify They Are Licensed in Your State: Payday lending is regulated at the state level. Ensure the lender is licensed to operate where you live.

- Gather Your Documents: You’ll typically need a government-issued ID, proof of income (pay stubs), and your bank account details.

- Fill Out the Application Accurately: Do not fudge numbers. Be honest about your income and expenses.

- CRITICAL – Read the Loan Agreement Before Signing! This is the most important step. Do not skim it. Look for the exact loan amount, the fee, the APR, and the exact due date. If you don’t understand something, do not sign.

Smarter & Cheaper: The Best Alternatives to Payday Loans

This is the most important section of this guide. Before you even consider a payday loan, explore these options.

Payday Alternative Loans (PALs)

Offered by federal credit unions, PALs are the best direct alternative. They have a maximum APR of 28% (a fraction of a payday loan’s cost) and repayment terms from one to twelve months. You typically need to be a member of the credit union for one month to qualify.

Local Credit Unions

Even if you don’t qualify for a PAL, your local credit union may offer small personal loans with reasonable interest rates and flexible terms. They are non-profit institutions designed to serve their members, not to make a profit from them.

Asking for a Payment Plan from Creditors

If you’re behind on a utility bill or a medical payment, call the company directly. Many will happily set up a no-interest or low-interest payment plan to help you get back on track. This is always better than taking on new debt to pay old debt.

0% APR Credit Card (Introductory Offer)

If you have fair to good credit, you may qualify for a credit card with a 0% introductory APR for 12-18 months. This allows you to cover an expense and pay it off over time with no interest at all.

FAQs (Frequently Asked Questions)

Here are answers to some of the most common questions about payday loans.

What is the easiest loan to get approved for with bad credit?

Secured loans (like auto title loans, where you risk your car) or high-acceptance payday loans are often the easiest to get. However, they are also the riskiest. A Payday Alternative Loan (PAL) from a credit union is a much safer easy option to explore first.

What happens if you can’t pay back a payday loan?

The lender will attempt to withdraw the money from your bank account, which can lead to significant overdraft fees from your bank. They will begin aggressive collection calls and emails. Your credit score will be severely damaged, and they may sell your debt to a third-party collection agency.

Can a payday loan company sue you?

Yes. If you default on the loan, they can take you to civil court to obtain a judgment against you. If they win, the court could grant them the power to garnish your wages or place a lien on your property.

Conclusion

Final Verdict: Is a No Denial Payday Loan Right for You?

After reviewing all the evidence, the conclusion is clear. A payday loan should not be a solution to a long-term financial problem. It is a temporary, very expensive fix for a one-time, absolute emergency.

A payday loan might be a last-resort option if, and only if:

- You have a true, unavoidable emergency.

- You have exhausted every single alternative listed above.

- You are 100% certain you can pay the loan back in full on the due date without needing to borrow again.

Before you borrow, take a deep breath and review the alternatives one more time. Your future financial health depends on it. The ultimate goal is to build a small emergency fund so you never find yourself in this position again. Even saving $20 a week can build up over time and become the lifeline you need, one that you provide for yourself.